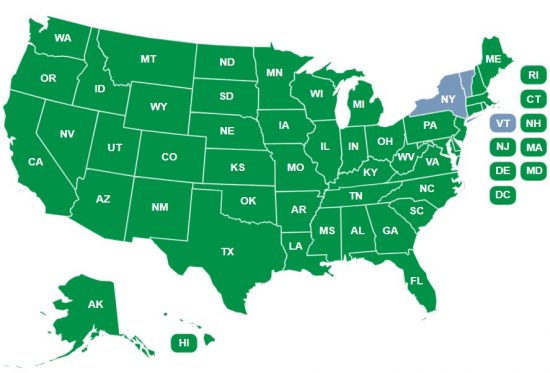

Licensed States, US

License, Registration, & Exemption Information

| State | Details |

|---|---|

| Wisconsin | Wisconsin Department of Financial Institutions, Mortgage Banker License #2125BA |

| Washington | Washington Consumer Loan Company License #CL-2125 dba Loanstream |

| Virginia | Virginia Lender License MC-6752 NMLS 2125 |

| Utah | Utah DRE Mortgage Entity License 6206538 – NMLS 2125 |

| Texas | SML Mortgage Banker Registration #2125 dba Loanstream |

| South Carolina | South Carolina-BFI Mortgage Lender/ Servicer License MLS-2125 |

| Pennsylvania | Mortgage Lender License #65662 |

| Oregon | Mortgage Lending License #ML-3613, NMLS #2125 dba Loanstream |

| Oklahoma | Mortgage Lender License #MLO10234, Licensed as a Mortgage Lender by the Department of Consumer Credit No. #MLO10234; NMLS #2125 |

| Ohio | Residential Mortgage Lending Act Certificate of Registration, RM.850267.000 |

| North Carolina | North Carolina Mortgage Lender License #L-172776, NMLS #2125 |

| New Jersey | New Jersey licensed by the N.J. Department of Banking and Insurance, Mortgage Residential Mortgage Lender License, NMLS #2125 |

| Nevada | Nevada Mortgage Company License # 3246 – NMLS #2125 dba Loanstream |

| New Mexico | Mortgage Loan Company License #02380 |

| Montana | Montana Lender License #2125 dba Loanstream |

| Minnesota | Minnesota Residential Mortgage Originator License #MN-MO20529627 |

| Michigan | Michigan 1st Mortgage Broker/Lender/Servicer/License FL0019770, NMLS 2125 dba Loanstream - Notice to Inquirers & Loan Applicants |

| North Dakota | North Dakota Department of Financial Institutions – MB103788 |

| Massachusetts | Massachusetts Mortgage Lender License #ML2125, not authorized to originate or process Massachusetts Reverse Mortgages |

| Maryland | Maryland Mortgage Lender License #14074 |

| Louisiana | Louisiana Residential Mortgage Lending License #2750 |

| Kansas | Kansas Office of the State Bank Commissioner - License/Registration #: MC.0001380 |

| Kentucky | Kentucky Department of Financial Institutions, Mortgage Company License # MC358503 dba Loanstream |

| Indiana | Indiana Division of Financial Institutions – 10909 dba Loanstream |

| Illinois | Illinois Residential Mortgage Licensee, #MB.6759942, Regulated by IDFPR – Division of Banking, 122 South Michigan Avenue, Suite 1900, Chicago, Illinois 60603, (312) 793- 3000 dba Loanstream |

| Georgia | OCMBC, Inc. dba LoanStream Georgia Mortgage Lender License / Registration: 20571 NMLSR: 2125 19000 MacArthur Blvd., Ste. 200 Irvine, CA 92612 |

| Florida | Lender Servicer License #MLD1130 |

| District of Columbia | District of Columbia Mortgage Dual Authority License #MLB2125 dba Loanstream |

| Colorado | Colorado – responsible individual R. Aziz #100020906 dba Loanstream. Mortgage Company Registration - 2125 |

| California | Licensed by the Department of Financial Protection and Innovation under the California Residential Mortgage Lending Act #4130724 |

| Alaska | Alaska Mortgage Broker/Lender License # AK2125, AK2125-1, AK2125-2, AK2125-3 |

| Arizona | Arizona Mortgage Banker License #0909401 |

| Connecticut | Mortgage Lender License # ML-2125 |

| Delaware | Delaware Lender License 028624 |

| Hawaii | Hawaii Mortgage Loan Originator Company License #HI-2125 Hawaii Mortgage Servicer License #MS251 |

| Maine | Supervised Lender License - 2125 |

| Rhode Island | Lender License - 20204027LL |

| Tennessee | Mortgage License 195411 |

| New Hampshire | New Hampshire Mortgage Banker License #23622-MB |

| Idaho | Mortgage Broker/Lender License MBL-2080002125 |

| Mississippi | Mississippi Mortgage Lender License # 2125. |

| Missouri | Missouri Mortgage Company License # 2125 In-State Office: Missouri In-State Branch License # 2396190 313 S South Suite 407 Springfield, MO 65806 |

| Arkansas | Combination Mortgage Banker-Broker-Servicer License #129809 |

| Iowa | Iowa Mortgage Banker License # MBK 2022-0131, 2022-0132, 2022-0133 |

| Alabama | Alabama Consumer Credit License # 23437 |

| Wyoming | Wyoming Mortgage Lender/Broker License # MBL-5179. Wyoming Consumer Lender License CL-4997. |

| West Virginia | West Virginia Mortgage Lender License # ML-2123 |

| South Dakota | South Dakota Mortgage Lender License # 2125 ML. |

Additional Legal & Licensing Information

Veterans Administration ID #169917-00-00, US Department of Housing and Urban Development ID# 20996-0000-1, dba Loanstream

Texas Consumers Complaint and Recovery Fund Notice

I Nordirland håller man på att genomföra ett informationsprojekt med huvudbudskapet Vardenafil “Get advice and feel better” (få råd och må bättre), där man uppmanar människor att inte använda antibiotika för att självmedicinera (figur 5).

Appraiser Independence Requirements (AIR)

OCMBC Statement of Adherence to AIR rules:

AIR is meant to improve the reliability of home appraisals and to maintain appraiser independence from influence by other parties. The aim of the rule is to assure that all parties involved in the mortgage transaction receive fair and independent property valuation reports. The rule also mandates that a mortgage applicant be provided a copy of all appraisal reports. OCMBC, Inc. is committed to 100% compliance with the AIR rules.

California Consumer Privacy Act (CCPA)

OCMBC, Inc. is in compliance the Act. The CCPA was signed into law on June 28, 2018, and went into effect on January 1, 2020. CCPA grants California consumers robust data privacy rights and control over their personal information, including the right to know, the right to delete, and the right to opt-out of the sale of personal information that businesses collect, as well as additional protections for minors.

Visit the California Attorney General web page for complete information.

Gramm Leach Bliley Privacy Policy Act of 2000

1. OUR PLEDGE TO YOU

OCMBC, Inc., one of our top priorities is making sure that the information we have about you is protected and secure. We value our relationship with you and work hard to preserve your privacy and ensure that your preferences are honored. At the same time, the very nature of our relationship may result in us collecting or sharing certain types of information about you. We explain

how we use customer information in this privacy policy statement. We invite you to state your choices in the Customer Preferences section. We will honor your selection.

2. INFORMATION WE COLLECT

We collect information, you give to us on applications, surveys, registration forms, etc.

3. HOW WE SHARE INFORMATION

We do not share information that we have about you with anyone except in response to subpoenas or for other legal reasons.

The law permits us to share information about our current and former customers with government agencies or authorized third parties under certain circumstances. For example, we may be required to share such information in response to subpoenas or to comply with certain laws.

4. HOW WE PROTECT INFORMATION

We strive to protect your data and safeguard it from those not authorized to see it.

5. FORMER CUSTOMERS

We do not share information about our former customers with anyone except in response to subpoenas or for other legal reasons.

We do not share information about our former customers with companies outside our organization for them to contact you for their own marketing purposes.

6. CUSTOMER PREFERENCES

We honor your choices for sharing data as checked below. Please fill-out this form and return it to us at:

OCMBC, Inc.,

19000 MacArthur Blvd Ste. 200

Irvine, CA 92612

[] Please do not share information about me with companies outside your organization. By law, this doesn’t include companies that are performing services on our behalf or our financial marketing partners.

[] Please do not share my credit history with members of your corporate family.

For joint accounts:

We will honor your preferences, and will automatically apply those same choices to the other account holder(s).

Name:__________________________________________________________

Address:________________________________________________________

City:_______________________________State:______Zip_______________

Account/Policy

No(s):______________________________________________

In addition, you may share with us your preferences by calling us toll-free at:

(800) 760-1833 or by e-mailing us at: corp@OCMBC.com.

Copyright 2016-2020 | LoanStream is a registered DBA of OCMBC, Inc. NMLS ID #2125 – NMLS Consumer Access.

Programs and rates are subject to change without notice.